YouTube Advertising for Orbit vs. Trident: It’s a Lot to Chew On

by Thomas Owadenko - REELSEO.COM

If you’re reading this blog you probably know that Google has an AdWords for Video service, also known as TrueView. These are promoted YouTube videos that are most frequently viewed as a pre-roll in front of other YouTube videos, usually with a “Skip Ad” option after five seconds. You may not know that views of those five seconds-plus are added to a promoted video’s overall public view count.

Some people may argue that this distorts the validity of the view count as an indicator of the video’s popularity (and, if it’s an ad, the video’s effectiveness). At Octoly, we agree with this sentiment. In fact, the number one indicator of video success should not be views at all, but rather it should be engagement with the video through comments, likes and shares. And, if you’re a brand, a video’s effectiveness should be ranked by how well it helps meet your KPIs, ideally with some sort of conversion goals in mind.

Paid Promotion is a Legitimate Video Marketing Strategy

However, paid campaigns are a legitimate and sometimes essential part of any promotional effort. No one quibbles with the fact that ads on television are paying for views, and the same should hold true for YouTube. “Paid” is not, and should not be, a dirty word. In fact, these paid views are what drive the entire YouTube economy, enabling us to watch incredible videos from independent creators around the world.

But paid views are only one part of the equation. What brands are often missing is the level of engagement in those videos. In fact, most brands don’t actually know how much of their views are from organic means (their “owned” media), and how much are due to video promotion due to TrueView and other paid avenues via Facebook, Twitter, and other websites.

Many marketers look at a video’s overall public view count and accept it as the only metric needed. As a result, marketers and agencies frequently buy enough traffic via the Google AdWords for Video/TrueView format to reach a certain view count. And when they get those views, their job is done. No other data is needed.

But do brands realize that most of these low-engagement paid views are of much less value? And are executives getting the facts about how many of their views are paid and how many are organic? The owned vs. paid data is a very opaque part of the YouTube ecosystem, and yet it’s crucial for brands to have this data in order to set their goals and plan their budgets. These metrics are even more important when trying to understand competitor budgets.

Orbit Gum vs Trident: Paid Media vs Earned Media

At Octoly we saw a need for this kind of analysis, so we developed a system to break out YouTube channels by earned vs. paid media. To show you how it works, and why this type of data is important, today we’re going to compare two brands, Orbit Gum and Trident.

In 2012 Trident had a market share of 23.8%, while Orbit had 20.6%. But over the last few years, the $2.7 billion gum market in the U.S. has been shrinking. Apparently, young people are simply chewing less gum. Cue YouTube, where young people hang out.

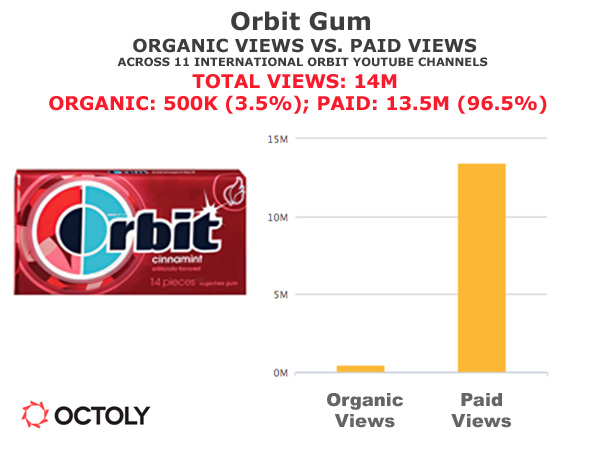

For Orbit, we tracked 11 YouTube channels across various countries. Orbit had 14 million views overall, with 500,000 views or 3.5% organic (aka “owned”) and 13.5 million (96.5%) paid.

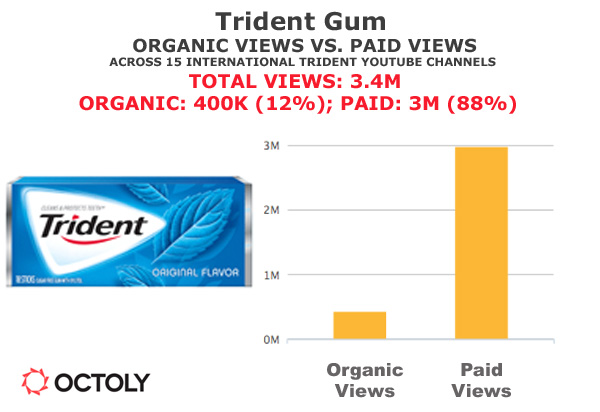

For Trident, we tracked 15 international channels totaling 3.4 million views, of which 400,000 views (12%) were organic (owned) and 3 million (88%) were paid.

Some videos are clearly paid pre-roll videos that have no organic lift, such as this Trident video: “Trident Gum Helps Fight Cavities – Super Useful.”

This is a 15-second video that has 39 likes and six comments, and yet it has an astounding-if-organic 2,150,000 views. But this is not a video that lends itself to sharing. According to thevidIQ Vision Chrome extension, the video received 37 Facebook likes, 145 Facebook shares, 23 Facebook comments and 48 tweets. The channel only has 4,883 subscribers, which would get it a maximum of about one thousand organic views from that subscriber base. So, overall, this video can essentially be counted as about two million paid views.

This Orbit video “Orbit Gum Commercial – Sarah Silverman Dumps Coffee (:15)” has 9.9 million views, 646 YouTube likes, 159 dislikes, with 53 comments. The video had 922 Facebook likes, 1,562 Facebook shares, and 594 Facebook comments. It was tweeted 82 times. This channel 4,807 subscribers, so it could also expect about a thousand organic views among subscribers.

To get a reality check we can compare the Orbit numbers with the recent Friskies commercial “Dear Kitten,” which was distributed on BuzzFeed’s YouTube channel. BuzzFeed has publicly stated that all its videos are entirely organic, and this presumably holds true when it comes to promotions. “Dear Kitten” has 15.1 million views (just 50% more than the Orbit video), but it has 100,000 YouTube likes (154X the Orbit video) and 6,000 YouTube comments (113X the Orbit video). While we don’t like to use the term “viral” very much, Friskies indeed earned that distinction. In comparison, Orbit’s commercial was a creative, cute and funny video that was unfortunately not very shareable.

Organic Views vs Paid Views

Other paid video campaigns are more challenging to break out from organic views. But by analyzing millions of videos we were able to develop an algorithm that is a reasonable estimate of paid views.

We believe that the YouTube TrueView system, when used as part of a best practices strategy, can be an effective part of any campaign. But it is useful for brands to have a holistic view of how much of their views are being driven by organic shares and how much is by paid views. Importantly, videos that are produced specifically with YouTube sharing and commenting in mind, rather than as repurposed one-to-many TV spots, can have much more engagement, and thus higher rates of success. Both Orbit and Trident could benefit by better understanding their mix of organic vs. paid views. Of course, all that data is a lot to chew on.

Close